The United Kingdom continues to debate what will be the best trading arrangement with the European Union and third countries once it leaves the EU.

The United Kingdom continues to debate what will be the best trading arrangement with the European Union and third countries once it leaves the EU.

Last week the House of Commons’ Exiting the EU Committee report stated that if the final Brexit deal does not pass fifteen 15 key tests such as maintaining zero tariffs on UK-EU trade and keeping an open border between Northern Ireland and the Republic of Ireland, the recommended post-Brexit option for the UK should be to remain in the European Economic Area or join the European Free Trade Association.

But let’s face it: Brexit regardless of its final shape will cost the UK economy. And it is likely to destroy more jobs than it creates. The question for policy makers will be on how to mitigate the impact. But where to start? Certainly in Britain’s most vulnerable regions?

Before the Exiting the European Union Select Committee released the Government’s EU Exit Analysis, at the UK Trade Policy Observatory we had already looked at the impact of different post-Brexit trade scenarios on UK manufacturing output and jobs. Our modelling of the impact of Britain’s future trading arrangements is at a very detailed level, covering 122 sectors across the entire UK, and differentiating between high and low-tech sectors.

The trade policy scenarios for Britain’s trade arrangements post-Brexit, which we modelled, included:

- ‘European Economic Area (EEA)’: This option would keep UK regulations aligned with the EU’s and thus involve some (but relatively little) extra trade friction at the border.

- ‘Free Trade Agreement (FTA) with the EU’: The FTA option would keep many trade barriers – such as pre-shipment inspections and other formalities – between the EU and the UK low. But there will be differences in regulatory standards and the need for exporters to provide conformity assessments at customs.

- ‘No deals’ – or ‘World Trade Organisation (WTO)’ option: Under this option there is no preferential access to the EU market. Customs duties on goods would be reintroduced at the border. Under this scenario there are also no preferential trade deals with any third country.

- ‘Free Trade Agreements (FTAs) with all non-EU’: Under this scenario the UK signs no free trade agreement with the EU but concludes such pacts with all non-EU countries in the world.

All these scenarios foresee that Britain will leave the EU’s customs union.

We find that under any Brexit scenario, UK manufacturing output will fall, with output loss ranging between 2.1 and 5.5 per cent. There is no net gain for manufacturing outside being a member of the EU. In 2016, nearly half of the UK’s exports of goods were destined to the EU and some 55 per cent of UK’s goods imports came from the EU. By leaving the EU, we are erecting trade barriers against nearly half of our trade, which puts UK jobs at risk.

If the worst comes to pass, and the UK trades with all countries on the WTO terms, more than 70,000 manufacturing jobs may be at risk across Britain’s 380 local authority districts. We also find that some manufacturing sectors may grow and some local authority districts may gain jobs.

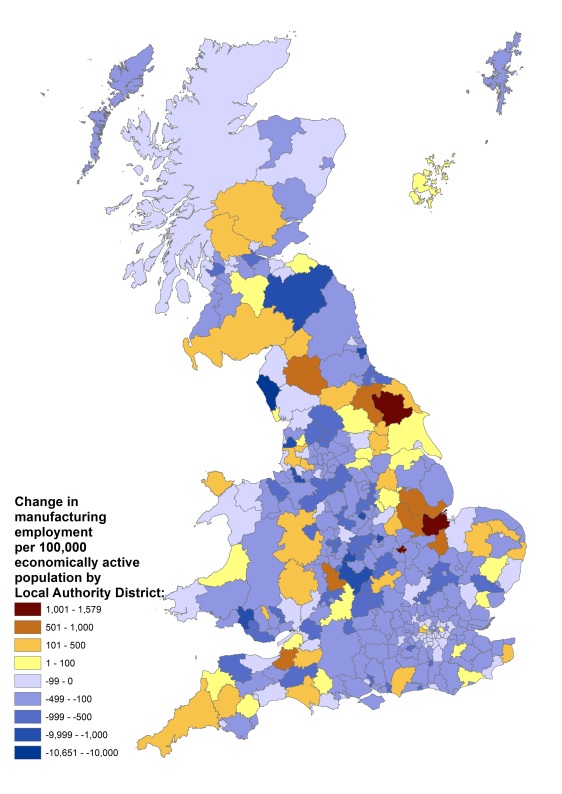

Impact of ‘no deals’ on manufacturing employment across Local Authority Districts

(Source: Authors’ own analysis; Business Register and Employment Survey, 2016; Annual Population Survey, 2016; Ordnance Survey Boundary-Line.)

North East and West Midlands manufacturing jobs hardest hit

A ‘no deals’ Brexit would be the most pessimistic outcome for UK industry jobs. Nationally, failing to agree an FTA with the EU and failing to roll-over the existing EU FTAs with 67 partner countries may put some 74,000 manufacturing jobs at risk.

Looking at different UK regions, the North East and West Midlands appear most vulnerable to Brexit. For every 100,000 economically active residents in these regions, more than 400 manufacturing jobs in these regions could be lost if the UK was to leave the EU with no deal. This would mean more than 5,000 manufacturing jobs lost in the North East, and more than 11,000 lost in the West Midlands.

Sunderland, Birmingham, Coventry and Derby are most vulnerable to the adverse effects of Brexit on high tech sectors – because of their established motor vehicle sector in these cities.

At the other end of the scale, London and Yorkshire and the Humber appear to be the least vulnerable to Brexit’s effects of manufacturing. In the case of London this is simply because the British capital has a very small manufacturing base. Yorkshire and the Humber (which has a sizable food processing industry) might even gain employment in lower tech manufacturing sectors under a ‘no deals’ scenario.

How different post Brexit trade scenarios will impact manufacturing employment across UK regions

(Source: Authors’ own analysis; Business Register and Employment Survey, 2016; Annual Population Survey, 2016.)

How about the softest ‘EEA’ option? This option too will cause manufacturing job losses across all UK regions, particularly in the North, the Midlands, Wales and Northern Ireland. Across the UK, some 32,000 manufacturing jobs may be lost under this scenario.

This is because this scenario fails to adequately resolve the ‘rules of origin’ problem. In the absence of EU customs union membership, exporters will face new administrative costs as they will be required to prove the origin of goods to customs authorities and border inspections will be necessary to check for compliance to benefit from duty free access to the EU market – and vice-versa.

Rules of origin are more likely to be particularly disruptive to complex just-in-time supply chains, such as in the motor vehicle sector where parts and components often cross borders multiple times before a car is assembled. Customs union and single market membership allows manufacturers to source inputs quickly and cut costs by reducing the amount of goods and materials held in stock.

Finally, under the ‘FTA with the EU’ scenario, job losses may be higher still. At least 56,000 manufacturing jobs are at risk across the UK.

But surely having ‘FTAs with all non-EU’ countries can make up for the lost trade with the EU? We find that this is not the case.

Any winners?

We also find that some UK regions, especially those with a large food processing industry, may actually fare better under more ‘pessimistic’ Brexit scenarios. This is because under a ‘hard Brexit’ – or ‘no deals’ scenario – these would enjoy greater protection from imports as the UK replicates the EU’s own customs arrangements. Signing global trade deals with non-EU countries on the other hand may expose domestic food producers to import competition from cheaper non-EU suppliers.

In sum, trade creates both winners and losers – and the modelling of manufacturing at a granular level of 122 sectors allows us to ‘dig deeper’ and reveal a nuanced pattern of winners and losers across different sectors and different parts of the country.

This is important for policymaking. While in Britain’s post-Brexit trade world, more jobs are likely to be lost than gained, part of that damage limitation should be to consider the impact on Britain’s most vulnerable regions.

Ilona Serwicka is Research Fellow in the Economics of Brexit at the UK Trade Policy Observatory

Read the full UK Trade Policy Observatory report: Which Manufacturing Sectors are Most Vulnerable to Brexit? Briefing Paper 16 – February 2018